Q3 global cellular IoT modules, Chinese companies took the top three

tech

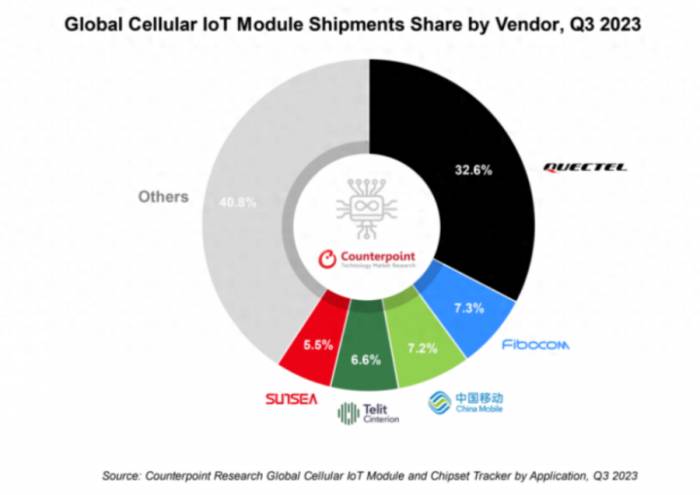

According to Counterpoint's latest report, "Global Cellular IoT Module and Chipset Tracker (by Application)," global cellular IoT module shipments declined by 2% year-over-year in the third quarter of 2023. Weak demand, rising interest rates, and cautious spending by enterprise IoT participants are some of the significant factors contributing to the market slowdown.

The 5G market's share in the global cellular IoT module market has broken through 5% for the first time, indicating the appeal of 5G adoption. However, 5G applications are currently limited due to the lack of killer use cases and higher prices. We have only witnessed early adoption in the router/CPE, PC, and automotive markets.

Advertisement

The IoT module market is undergoing a technological transition from 4G Cat 1 and NB-IoT to 4G Cat 1 bis. The low-cost, high-energy-efficient 4G Cat 1 bis is becoming increasingly popular in many applications, including POS, smart meters, telematics, and asset tracking.

Commenting on market dynamics, Counterpoint's Associate Director Mohit Agrawal said, "The top five applications, including smart meters, automotive, POS, routers/CPE, and telematics, account for over 60% of the total cellular IoT module shipments this quarter. Notably, only the smart meter and router/CPE segments have seen positive growth in shipments, while others have declined. India is the only region in the global cellular IoT module market that has achieved positive growth."

According to the report, shipments from Quectel and Telit have declined. This trend reflects the general situation of the Chinese and global IoT module markets. However, Quectel's performance in the global market has slightly improved quarter-over-quarter.

In contrast, the other two manufacturers in the top five—China Mobile and Fibocom—have seen positive growth. This growth is driven by China Mobile's smart meters, asset trackers, and POS, as well as Fibocom's router/CPE applications.

China Mobile has recently established a subsidiary, Bilin Zhilian, to accelerate the growth of its module business. Its legal representative is Ding Yuan, with a registered capital of 100 million RMB, and its business scope includes IoT technology research and development, software development, electronic component manufacturing, internet data services, mobile communication equipment sales, and smart vehicle device manufacturing. The equity panorama penetration map shows that the company is wholly owned by China Mobile IoT Co., Ltd., which is a wholly-owned subsidiary of China Mobile Communications Co., Ltd.

Chinese brands such as Jiulian Technology (Unionman), Shanghai Hezhou Communication (OpenLuat), and Lierda Technology have shown positive performance from a niche perspective. Applications in the smart meter, asset tracking, and POS sectors have driven their growth.

Commenting on the future outlook, Counterpoint's Senior Research Analyst Soumen Mandal said, "It is expected that global cellular IoT module shipments will decline by 5% year-over-year in 2023. However, demand is expected to recover in the second half of 2024, with significant growth anticipated in 2025, coinciding with the large-scale adoption of 5G and 5G RedCap. In the long term, the cellular IoT module market has a broad outlook, with applications such as smart meters, routers/CPE, POS, automotive, and asset tracking driving most of the market's growth."Q2 China Mobile Ranked Second

According to Counterpoint's latest Global Cellular IoT Module and Chipset Tracker (by application category) report, global cellular IoT module shipments (excluding automotive embedded and telematics modules) declined by 5% year-over-year in the second quarter of 2023. Factors contributing to the decline include weakened demand and a sluggish economic sentiment. Except for smart meters and Point of Sale (POS) devices, which are the two most significant applications, shipments in most segments have seen a substantial decrease. Smart meters, POS devices, and asset trackers accounted for approximately 56% of the market share in the second quarter of 2023. India was the only market to achieve positive shipment growth during that quarter.

Deputy Director Mohit Agrawal commented on market dynamics, stating: "In the second quarter of 2023, many component manufacturers experienced a decline in shipments as the market shrank for the first time since the pandemic outbreak. The demand for connected devices triggered by the pandemic is waning, and the digital transformation efforts in industries and other key verticals have not yet translated into shipments. Quectel's international market revenue has surpassed its revenue from the Chinese market. Due to security concerns, Chinese module suppliers are increasingly under scrutiny by the United States. This scrutiny may challenge their global expansion plans, paving the way for other suppliers to seize more opportunities."

Leading component supplier Quectel saw its market share slip due to weak demand. China Mobile, with its strong performance in smart meter, POS, and asset tracking applications, overtook Telit to become the second-largest vendor in the global cellular IoT module market.

Telit faces challenges due to the market downturn. With India expected to be the fastest-growing market by 2030, Telit recently partnered with VVDN to manufacture IoT modules in the country and expand its business there.

Commenting on the future outlook, Senior Research Analyst Soumen Mandal said: "The full-year 2023 IoT module shipments are expected to be on par with 2022. The IoT module market is showing early signs of recovery, with the second half of 2023 expected to perform better than the first half. However, lower demand is affecting the market's long-term growth trajectory, and the current demand is expected to shift over 2-3 years."

Mandal added: "The adoption of 5G technology has been slower than anticipated, primarily due to its higher costs, coverage issues, and the maturity of the 5G device ecosystem. The upcoming 5G RedCap has the potential to become a game-changer for the industry by offering more affordable solutions. 5G RedCap is expected to be adopted early in POS and router/CPE applications."