Falling for six consecutive quarters, what happened to this chip giant?

tech

Samsung's operating profit fell for the sixth consecutive quarter, with an estimated annual decrease of 35% to 2.8 trillion won.

On January 9th, Samsung Electronics announced its financial guidance for the fourth quarter of 2023, showing that the company's operating profit has declined for the sixth quarter in a row. Despite some improvement in chip prices, its chip, television, and home appliance businesses continue to be sluggish. Samsung Electronics will release a complete earnings report on January 31st, which will include a breakdown by division.

Samsung Electronics reported a 35% drop in operating profit for the fourth quarter of 2023 to 2.8 trillion won (approximately $2.13 billion), compared to the average analyst expectation of 3.7 trillion won; operating revenue fell by 4.9% year-over-year to 67 trillion won, while analysts had forecast 70.31 trillion won.

Advertisement

This outcome reflects the continued weak demand for smartphones and memory chips that support modern electronic products, given the economic uncertainty.

Although weaker than expected, this is the smallest year-over-year profit decline for Samsung Electronics in five quarters. Due to Samsung's production cut measures, chip prices rebounded in December last year, and it is anticipated that memory chips will see a recovery in 2024, with this trend expected to continue.

According to TrendForce data, mobile DRAM chip prices are expected to rise by 18%-23% in the fourth quarter of 2023, while mobile NAND flash memory chip prices are expected to increase by 10%-15%.

Analysts have indicated that Samsung's chip division may see a reduction in losses for the fourth quarter of 2023, with losses of 4.36 trillion won in the second quarter and 3.75 trillion won in the third quarter. As the DRAM business returns to profitability, its memory chip profitability has improved.

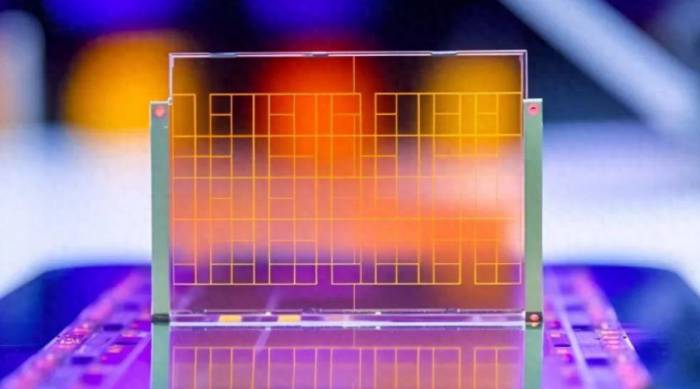

Samsung Electronics is now aiming to catch up with competitors in the emerging field of high-density memory chips, planning to increase capacity by 2.5 times by 2024. HBM is an advanced chip capable of processing data more quickly, which can be used in conjunction with hardware, such as NVIDIA's accelerators, to speed up data processing for intensive tasks like training AI models.

However, analysts have stated that the profits from Samsung's non-memory chip, television, and home appliance businesses were lower than expected, which may be part of the reason why Samsung's performance failed to meet market expectations.Analysts have indicated that in the fourth quarter of 2023, Samsung's mobile business may see a shipment decline of approximately 1 million units each for its two flagship foldable models compared to the third quarter, leading to a slight decrease in profits.

In the joint New Year's message from Samsung Electronics Co-CEOs Han Jong-hee and Kyung Kye-hyun, they outlined the strategic focus on pursuing "super-gap technology" and other core values to maintain a competitive edge.

They stated: "We will prioritize strengthening the foundational competitiveness, including the core values of Samsung Electronics such as super-gap technology."

They urged Samsung Electronics' chip manufacturing division to enhance and widen the technological gap with competitors, further solidifying their position. Over the past 50 years, Samsung Electronics has been at the forefront of semiconductor technology.

For the mobile, home appliance, and software divisions, they emphasized a customer-first strategy, focusing on performance and quality.

The two CEOs also called for proactive measures to address future changes such as artificial intelligence (AI), environmental practices, and lifestyle innovations, urging a fundamental shift in thinking and the application of generative AI to workflows. "We should fundamentally change our way of working and device experience by applying generative AI to our work. Moving away from a passive green reaction, we should achieve a fundamental shift in thinking and discover future green products."

Consumer electronics demand remains lukewarm.

In October last year, Samsung predicted that the long-slumping memory chip market would gradually rebound in 2024, driven by the boom in AI development. Samsung executives stated at the time that memory chip prices should start to emerge from the trough around the second half of 2023.

However, this latest earnings guidance indicates that the situation is not as optimistic as Samsung had previously anticipated.

Tom Kang, Head of Research at Counterpoint Technology Market Research, said: "I think this suggests that the rebound is slower than any of us imagined... the price increases are not as rapid, and demand in certain industries is not as strong."In contrast, last December, Samsung's main competitor in the semiconductor field, Micron Technology, announced better-than-expected revenue prospects, indicating that the recovery in data center demand has offset the impact of lukewarm demand for computers and mobile devices.

Gaining New Growth Momentum with HBM

Samsung Electronics is currently aiming to catch up with its competitor SK Hynix in the HBM chip field and gain new growth momentum.

HBM is an advanced chip that processes data at a faster speed, and when used in conjunction with hardware such as NVIDIA's accelerators, it can speed up data processing for intensive tasks like training artificial intelligence models.

Under the boom of artificial intelligence, the demand for HBM has surged recently. Sources have recently revealed that NVIDIA has paid large advance payments to SK Hynix and Micron to ensure a secure supply of HBM3 memory. SK Hynix has already planned to increase its capacity in this field by 2.5 times by the end of 2024.

Samsung hopes to drive growth in 2024 by launching new devices and a foldable screen product line. Samsung will launch the Galaxy S24 series flagship smartphone with built-in Galaxy AI features in the United States on January 17th.